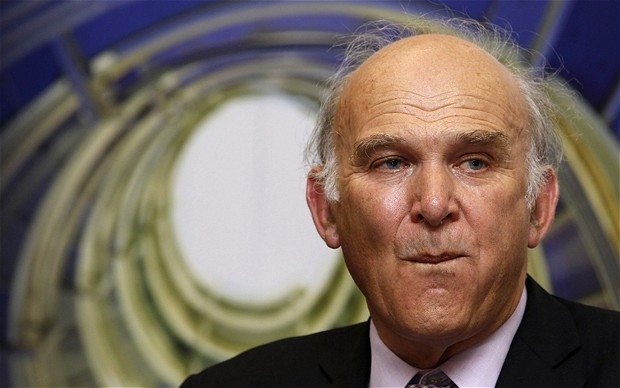

Speaking at the Liberal Democrat party conference, Mr Cable said that over the last two years, the government had done much to support enterprise, scrapping unnecessary red tape on small business and strengthening regulation where necessary, reports The Telegraph.

“We have seen off the ‘head bangers’ who want a hire and fire culture and seem to find sacking people an aphrodisiac: totally irrelevant in a country with flexible labour markets which have created over a million private sector jobs in the last two years,” said the business secretary.

“Instead, we have concentrated on practical tribunal reform and supported progressive firms who want worker participation and share ownership.”

Earlier this year, venture capitalist Adrian Beercroft published his government-commissioned report, in which he suggested allowing companies to sack workers with a payout, in return for them never bringing a tribunal claim against the company.

The so-called “no-fault dismissal” plan would see companies be able to get rid of staff easily rather than face the prospect of costly tribunals from disgruntled former workers.

Earlier this month, Mr Cable admitted that the government was trying to “have it both ways” by making it easier for employers to sack workers while attempting to protect employee rights.

Reforms to labour market rules will introduce a new cap on settlements and a fast track process designed to avoid expensive industrial tribunals.

During Mr Cable’s speech on Monday, he also confirmed that the government is providing £1bn of backing for a “business bank” to offer long-term financing to small and medium-sized companies.

“I am working with the Chancellor to develop a new institution that will combine a billion pounds of new government capital with a larger private sector contribution,” said Mr Cable.

“This will apply leverage through guarantees to support up to £10bn of finance to small and mid-sized business – a significant portion of all the lending currently available.”

He warned that the country was currently in a “dangerous phase” of the financial crisis, as consumer spending is squeezed by falling real incomes and debt and exports to the European Union are hit by the eurozone crisis.