Rupert Lee-Browne, founder & CEO of Caxton FX: “I would like to see the introduction of tax incentives to entrepreneurs that will actively encourage them to grow their businesses rather than sell out.

“Britain’s economy depends on the wealth and job creation that our entrepreneurs generate, which is why I am calling for more favourable tax treatment of dividends for founder shareholders that should be given once a company has been running for several years. This will support UK entrepreneurs in their campaign for growth and inspire them to continue building their businesses, in turn generating further wealth and job creation for the nation.”

“Exporting is vital for the long-term growth of the economy, and I want to see a Budget that encourages British businesses to be selling more overseas rather than buying. The government has already made considerable improvements in encouraging this, but much, much more can be done.

“I would like to see the Chancellor reduce the complications in export licensing and encourage alternative sources of finance to help fund exporters, such as offering favourable credit terms to overseas buyers of UK goods and services. This would go a long way to making them more attractive to potential exporters.”

Peter O’Toole, Chief Executive Officer of Retail Merchandising Services, a business that provides services to the retail sector across the UK, said: “I would certainly value an extension of the 2% cap on business rates in England and Wales. This measure will give confidence to the retail sector and help protect thousands of jobs, providing a much-needed boost to local high streets. I would also welcome the extended reduction of business rates for small businesses. With nearly 150,000 small, independent retailers in the UK, this support would be invaluable in helping them to grow and invest. The Government must also continue its reoccupation relief for new occupants of previously empty retail premises, as retailers continue to battle the rise of online shopping.

“If business rates do increase again in this budget, this will hit struggling retailers where it hurts, resulting in job losses, harm to local economies and further damage to our high streets.”

Tim Walker, MD of Taylor Made Computer Solutions based in Fareham, Hampshire: “I wouldn’t be surprised to see the chancellor use some of the money saved in public sector cuts to fund pre-election tax cuts for small businesses and entrepreneurs.

“We need to drive more enterprise, so I’d like to see either a cut in the rate of corporation tax for them, or more widespread release of funds through the EIS and SEIS schemes to encourage entrepreneurs to start up and grow businesses.”

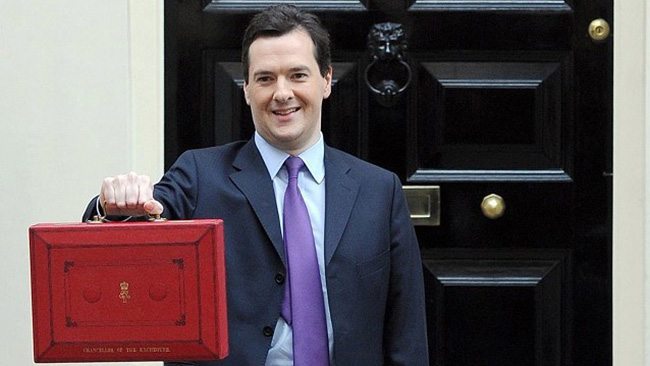

Drew Thomson, Group CEO, Starcount: “There’s no question the economy is looking up for British entrepreneurs, but we’re still seeing 74 per cent of business owners saying they expect their workforce to stay the same size this year. We need to see George Osborne announce a Budget that really taps into the potential that start-ups have, to provide the UK with a much-needed injection of job creation. I’d like to see the Chancellor bring in more dynamic tax relief for entrepreneurs, tax relief tied not to the company’s value but the number of jobs it creates. It’s also worth pointing out that, as tax incentives stand, small business owners are being actively incentivised to hold onto their equity. What the tax code should be doing is encouraging entrepreneurs to share equity with employees.”

“One of the major problems I’ve encountered is that the kind of entrepreneurial individuals who have the potential to really get the British economy rolling again are finding it impossible to get mortgages because of their ‘self employed’ status. If George Osborne is serious about reinvigorating business and job creation, more pressure needs to be put on banks to provide entrepreneurs with the basic personal security they need to launch their businesses.”

Matt Jones, Founder and Media Director of Cardiff-based advertising agency, Studio Tri, and London sister agency, S3, said: “Tax burdens are currently too high on smaller firms. Despite the small business rate relief scheme being extended for another year, it is not enough. I would welcome an indefinite extension, which would ease the pressure on small businesses, foster economic recovery and help them thrive.

“While 80,000 large businesses gain from corporation tax reductions under the coalition Government, 1.5million smaller companies have not benefited. I would urge the Chancellor to bring forward corporation tax cuts by a year to April 2014, to reassure small business owners, and support growth.

“Ultimately, small businesses will create the jobs of the future. I would echo the CBI’s call for the Government to boost access to finance. After all, it is crucial for companies to grow.”