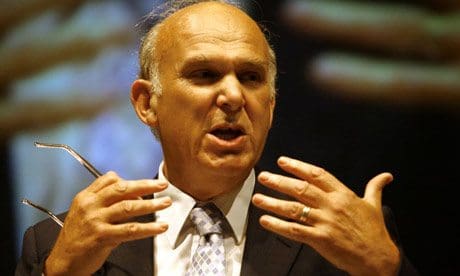

British businesses should look for funding outside the banking sector, Business Secretary Vince Cable has said, marking the latest effort to generate growth among small-and medium-sized businesses.

Faced with a barely growing economy, the government has targeted smaller companies as a major source of growth and has introduced reforms to encourage start-ups and make it easier for existing businesses to expand, reports The Telegraph.

“Britain’s businesses cannot grow, export and innovate without proper access to bank credit. But they also need alternatives when looking for finance,” said Mr Cable. “The government wants to see a shift in the market structure towards non-bank lending.”

Bank funding for SMEs has shrivelled in the wake of a global banking crisis, which has made traditional lenders more cautious and, according to a recent UK study, created a cash-flow crisis that is stifling small firms.

Mr Cable’s comments coincided with the launch of a guide to alternative sources of financing, published by business lobby group the Confederation of British Industry (CBI).

The CBI said high-growth, medium-sized businesses could be worth an additional £20bn pounds ($30.4 billion) to the British economy over the next seven years if they can gain access to finance through alternative channels.

The CBI highlighted traditional but underused funding options, such as the retail bond market and private debt placements, but also promoted more innovative approaches such as online “crowd-funding” platforms which enable individuals and businesses to back specific projects.

Mr Cable’s comments came as data showed that the number of small companies complaining about bank loans to Britain’s top financial arbitrator rose sharply last year, supporting persistent claims by companies they are being denied access to finance despite a government push to boost lending.

The Financial Ombudsman received 17pc more complaints in 2012 compared with the previous year, according to figures obtained by UK finance provider Syscap.

Companies were most likely to complain about banks refusing to renew loans or overdrafts or renewing them with punishing interest rates or higher fees, Syscap said.

Firms were also unhappy at being offered the wrong type of finance, such as overdrafts that carry high rates and can be recalled at any time instead of loans.

New regulations brought in after the financial crisis have forced traditional lenders to cut risky financing and left many small businesses short of funds.

The British government has made increasing the flow of credit to small and medium-sized enterprises (SMEs) a central part of its plan to revive the UK’s flagging economy.

The rise in complaints to 612 from 522, along with other recent data, calls into question the effectiveness of its efforts.

“It is clear from the number of complaints that small businesses continue to face major difficulties when it comes to getting the appropriate kind of funding they need from banks,” said Syscap Chief Executive Philip White.

“We hear from small businesses that banks still use the tight credit environment as an excuse to impose high fees on their customers,” he added.

Only firms with fewer than 10 employees and annual revenues of less than €2m can complain to the Ombudsman, which deals with cases where banks and customers cannot agree a settlement.

Syscap’s White said SMEs’ access to funding could soon improve thanks to the government’s decision to extend and expand its flagship Funding for Lending Scheme (FLS).

Last month, the government said the FLS, which offers banks cheap credit if they increase lending to households and businesses, will last until January 2015.