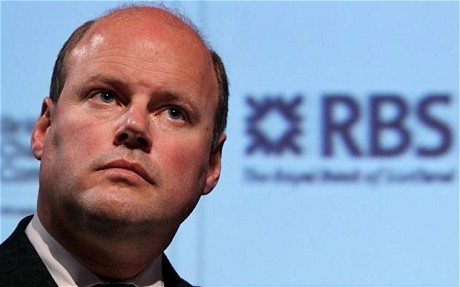

Mr Hester, who has run RBS since the height of the financial crisis in November 2008, has been asked to depart to allow the sale of the Government’s 81pc stake in the bank by the end of next year.

He will leave by the end of December despite repeatedly saying that he wanted to see through the privatisation process himself.

But the decision – rubber-stamped by RBS’s board at a meeting in London on Wednesday afternoon – came after the Treasury, led by Chancellor George Osborne, indicated that it wanted to return its stake to private hands by the end of 2014.

The Chancellor is believed to have wanted a new chief executive to lead the privatisation process. One source said that there was “no love lost” between Mr Osborne and Mr Hester.

Sir Philip Hampton, the bank’s chairman, admitted the decision to ask Mr Hester to step down followed a series of discussions with the Treasury.

The acceleration of considering succession for the CEO role arises largely from the Treasury’s determination to return the bank to the private sector by the end of 2014.

“We [the board] did agree that there would be a significant question mark over how many more years he [Mr Hester] had to do.”

Sir Philip admitted that he had discussed the issue of succession with UK Financial Investments (UKFI), which manages the Treasury’s stake in RBS, as he had with other investors.

It is believed Sir Philip may have sounded out investors about possible successors over the past few weeks.

“The board has been thinking about succession for a while,” said Sir Philip, adding that Mr Hester felt unable to make an “open-ended commitment” to lead the bank through its privatisation process.

The departure announcement, made after the markets closed in London, comes ahead of the final report Parliamentary Commission on Banking Standards, and the Chancellor’s Mansion House speech next week.

Treasury sources indicated that Mr Hester’s exit had been the subject of discussion for a number of weeks. However they attempted to play down suggestions of a rift with one saying that the decision for Mr Hester to leave “was by mutual agreement by all sides”.

In a statement, UKFI said that “now is the right time” to find a replacement to “lead the bank on its path to realising value for the taxpayer”.

Mr Hester said: “The board wants to put in place a fresh face for privatisation. It’s an entirely logical thing for the board to want to do.”

“I want to do what’s right for RBS,” he continued. The outgoing chief executive said the privatisation “would have been for me an end” adding that “if you’re looking for a window to have someone for whom it’s a beginning this is as good a window as you’re going to get.”