The government is finalising a £120m funding package to help secure a Chinese takeover of British Steel that would safeguard tens of thousands of jobs in and around new Conservative constituencies.

Sky News has learnt that Andrea Leadsom, the business secretary, and Nadhim Zahawi, the business minister who has driven government efforts to find a buyer for the insolvent company, met executives from Jingye Group on Wednesday.

A source close to Jingye described the meeting as “productive” and said that a package of Regional Growth Fund (RGF) support worth approximately £120m had been among the principal items on the agenda.

The government is expected to agree to the request for RGF funding in the coming weeks.

Last weekend, Jingye, which is based in China’s northern Hebei province, dismissed as “completely incorrect” reports that its takeover of British Steel was on the verge of collapse.

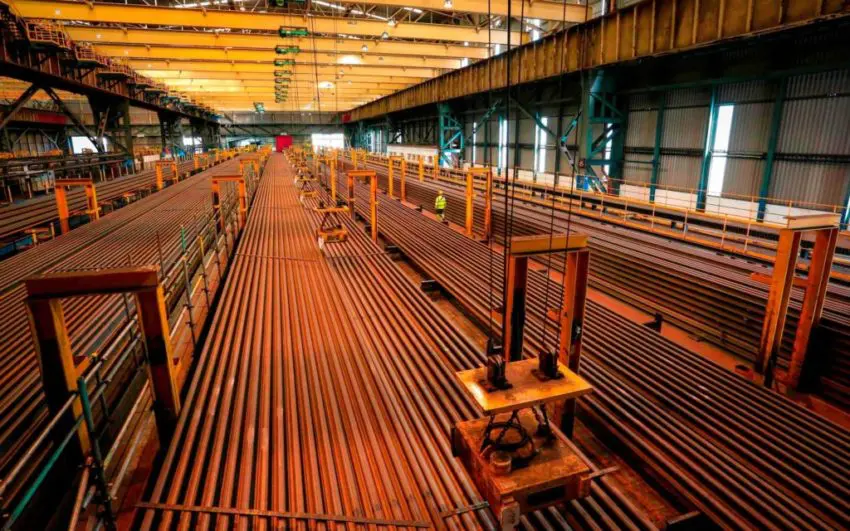

The Scunthorpe-based company employs about 4,000 people at its large steelworks in north Lincolnshire, as well as at sites on Teesside and elsewhere in northern England.

The Tories’ victory in last week’s general election turned substantial parts of Labour’s ‘red wall’ across northern England blue for the first time in generations – and in some cases, for the first time since the seats were created.

Some industry observers have questioned whether Jingye will be able to overcome capital controls in China in order to fund the takeover of British Steel.

A further potential obstacle has emerged in the form of a French government veto over the sale of British Steel’s Hayange plant, which is supposed to be part of the deal agreed between the Official Receiver and Jingye last month.

The fate of more than 4,000 British Steel workers, and of up to 20,000 additional jobs in its supply chain, rest on securing the company’s future.

Jingye’s revived appetite to acquire British Steel came after a period of exclusive negotiations with Ataer Holding, a Turkish company connected to the country’s armed forces pension scheme, failed to result in a deal.

The Chinese company has pledged to invest £1.2bn in British Steel during the next decade.

If approved, the £120m package of support from the RGF for Jingye’s purchase would be smaller than the sum sought by Ataer during its talks with the government.

People close to the process said that Jingye was committed to securing backing that complied with the government’s state aid obligations.

A rescue of British Steel would be viewed as an important sign of the government’s commitment to steel manufacturing in the UK, which has slumped in recent decades.

The company, which was previously a subsidiary of the Indian conglomerate Tata, has flirted with insolvency on previous occasions as the economics of steel production in the UK have become less attractive.

Loss-making British Steel fell into insolvency in May after the government decided against providing £30m to the company under its then-owner, Greybull Capital.

That came just weeks after Greg Clark, Ms Leadsom’s predecessor, agreed to provide an emergency £120m loan to cover the cost of an EU carbon credits scheme for industrial polluters.

A spokesperson for the Department for Business, Energy and Industrial Strategy said on Thursday: “The government continues to work with the Official Receiver and Jingye on the next stage of the sales process.”

Jingye which is headquartered in the country’s industrial heartland, also operates in the chemicals, hospitality and real estate sectors.

It employs more than 23,000 people and boasted sales of roughly £10bn last year.

Jingye declined to comment.