Trainline is finalising plans for a stock market float that is expected to value the rail and bus ticket website at about £1 billion.

Sources said that the route-planning and ticket-buying app could go public as soon as next month in the largest listing of a UK-based company this year.

Uncertainty over Britain’s departure from the European Union has put a chill on initial public offerings in London. Network International, a payment company, made its debut on the London Stock Exchange last month, but it is headquartered in Dubai. Last Thursday Watches of Switzerland, the luxury timepiece seller, unveiled plans for a potential float expected to value it at £800 million.

Trainline’s offering will generate a big profit for KKR, its American owner. The New York-based private equity group, best known for its hostile takeover of RJR Nabisco in 1989, bought the company for £450 million in 2015.

The ticketing company was founded in 1997 by Virgin Trains and was sold by a consortium that included Virgin to Exponent, a London-based buyout firm, in 2006. Its owner tried to float the company in 2014 but sold it to KKR instead. Formerly known as Thetrainline.com, it processes more than £3 billion of ticket sales a year in 45 countries and employs about 600 people in London, Edinburgh and Paris. In 2016 Trainline acquired Captain Train, a French rival, for £110 million.

Trainline is one of Britain’s rare so-called unicorns — fast-growing, privately owned, technology-focused start-ups valued at more than $1 billion. Others in the club, or close to joining, include Oxford Nanopore, which makes handheld gene-reading gadgets and is also tipped to float within a year, Benevolent AI, which applies machine learning to pharmaceuticals, and Monzo, the branchless bank.

Clare Gilmartin, 43, a former head of eBay’s European business, has run Trainline for the past five years. She said that the company had benefited from the complexity of the rail ticketing system, in Britain and elsewhere.

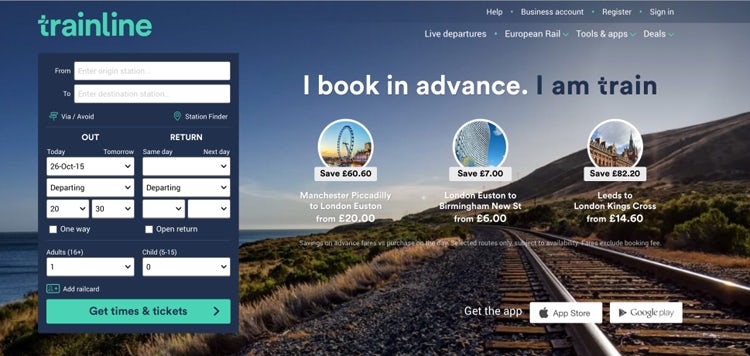

“If you go London to Birmingham, there are 16 different ticket types and 50 different fares,” Ms Gilmartin said, adding that there were more than 25,000 train stations in Europe and, unlike the airline industry, there was no centralised dataset or booking system to handle ticket sales. “We’ve aggregated all the choice on to one app [so that] users can access the network in a simple and easy way,” she said.

Trainline is Britain’s most popular service for buying tickets online and Ms Gilmartin said that she wanted to expand into Japan and North America. She predicted that consumers would buy a greater proportion of their train and bus tickets online. At present, between 60 per cent and 70 per cent of rail tickets were bought in stations, she said. “There’s no doubt more will go online and to mobile . . . Increased utilisation of the network is bloody good for the environment.”

In the year to the end of February last year, Trainline generated revenues of £167 million and a pre-tax profit of £38 million. However, its parent company, Victoria Investments, declared a loss of £55 million and claimed a £5.2 million tax credit owing to the cost of servicing its £577 million debt.

Ms Gilmartin declined to comment on the “rumours and speculation” surrounding its forthcoming float, saying that there was “no fixed sale plan at this point”.