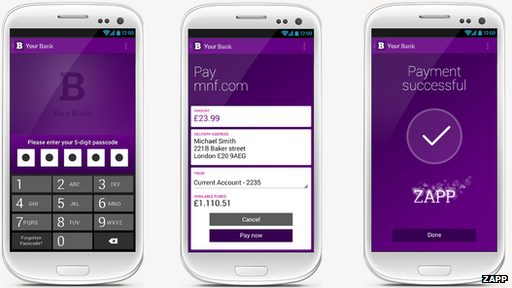

Zapp will enable these financial institutions to offer a new, secure, convenient and simpler way for their customers to pay for goods and services instantly in real-time using their existing bank accounts and their mobile device.

Zapp will enable consumers to benefit from real-time payments on their mobile phone banking applications, allowing secure payments between consumers and merchants. Zapp will be integrated into the mobile banking applications of these leading financial institutions, providing a seamless real-time payment choice to millions of customers as they shop.

HSBC, first direct, Nationwide, Santander and Metro Bank join WorldPay, Optimal Payments, Realex and SagePay as payment innovators in UK.

The alliance will work together to prepare the roll-out of Zapp payments to millions of customers, merchants and businesses. Together this group represents over a third of all UK bank accounts with 60 per cent of UK merchants being able to take advantage of Zapp payments. Zapp will continue to recruit new members to this alliance throughout 2014.

Peter Keenan, Chief Executive of Zapp, said, “I am truly excited to announce our lead financial institution partners: HSBC, first direct, Nationwide, Santander and Metro Bank. Together with our already announced acquirer partnerships, Zapp will go to market with real scale offering simpler, more secure and efficient payments to millions of customers and businesses. I am delighted that these financial institutions and acquirers have chosen to innovate to deliver value to their customers, lead the market and deliver huge benefit to the UK economy.”

David Yates, Chairman of Zapp and CEO of VocaLink said, “Zapp is a major payment innovation for Britain that will bring significant value to consumers, merchants and financial institutions. VocaLink is yet again proving that we are at the cutting edge of payment innovation, delivering significant value for the UK economy.”

Steve Pateman, Executive Director, Head of UK Banking, Santander commented, “Listening to, and responding to customers and their needs is at the heart of what we do at Santander. Our customers want the choice to be able to pay on the go using mobile technology, and the Zapp proposition is second to none with its capabilities. Santander is as delighted to be involved with this initiative as we think our customers will be, when they start using it. Zapp helps us meet the growing demand from our customers to use their mobiles to pay for goods and services swiftly and securely. With the vast majority of UK merchants on board, we expect to see rapid take up of payments powered by Zapp.”

Brendan Cook, Head of Retail Banking & Wealth Management at HSBC, commented: “Our customers’ use of mobile banking is growing rapidly. Introducing Zapp to our mobile banking services will mean customers can benefit from convenient, fast and secure ways to pay using their mobile devices.”

Paul Marriott-Clarke, Commercial Director of Metro Bank commented, “We’re excited to partner with Zapp on this launch. Metro Bank is committed to offering customers the best in service and convenience, through whatever channel they choose to use for their banking. Zapp is an exciting innovation that will provide something extra to those who want to bank through mobile devices, and we’re delighted to be involved.”