Although we’re obviously not privy to the intricacies of the bidding process there are some key questions and potential repercussions. According to Virgin’s own statistics, now might not be the best time to change the points on what is arguably the most vital and economically significant element of our transport network.

The service has grown from 13million customers in 1997 to 30million in 2011, there are 99% more trains per day and it has the best customer satisfaction score for any long distance rail service.

Despite the great track record of Virgin we may well also see it leave the market for good. Is this a preferential outcome in terms of competition, choice and success of the service in the future?

Best value versus high risk and reward?

We’re working with organisations continually to help them source products and services from suppliers to the right specifications at the right price. What we know from this is that long term best value is critical to the success of any contract.

While price is obviously front of mind in a buying decision it needs to placed in the context of best value. This includes factors like the capability of the chosen supplier to deliver, the ethical responsibilities of the buyer to its stakeholders (which in the case of the UK government are huge) and the balancing of risk versus reward.

In many tendering and sourcing situations we see clients offered a lower price but careful vetting of the supplier indicates that the risk of taking this price would be too great. It is essential that the new direction is not too high a risk on the promise of a much higher but less attainable reward.

Sustainability is critical

Sustainability is much more than a buzzword for businesses today – it’s a way of life. This is even more the case in the delivery of a critical public service.

Evidence shows that Virgin had met and exceeded expectations in terms of growing the service to where it is today. And it’s not a company known for resting on its laurels!

My assumption would be that its future estimations of where the service can be developed would be ambitious and optimistic even though they are realistic. Is it perhaps feasible that facing a market changer and disruptor like Virgin might force rival bidders out of their sustainability comfort zone in order to win?

Incumbents should have the advantage

While any deal or tender is open season, we find that in over 70 per cent of cases where the incumbents have delivered successfully they are reselected. There’s a sound reason for this. While they have to re-sell their offer as part of the process, buyer common sense prevails. They know what is takes to deliver and their future plans are based on real data in comparison to estimates.

Their proven ability and existing strong relationship is a major weighting factor against price. eAuctions are often won officially by a challenger on price but the final selection is made in the context of incumbent’s record and advantage.

Once again Virgin has proven itself by turning round and taking the West Coast line forward. As a regular Manchester to London traveller there are far more improvements to note than problems. Was the incumbent’s advantage correctly weighted?

All markets need competition

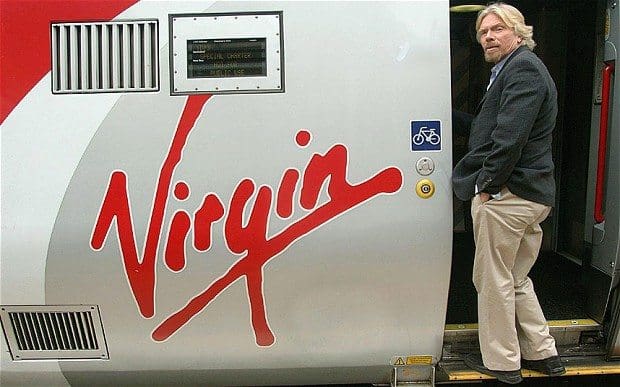

A market is not a market without good competition. Richard Branson’s statements following the bid win announcement suggest that we will not see the company bidding for rail network operations again.

This is due to the cost of bidding which he cited at £14million. While its Virgin’s decision if they step out of the market, it does raise the point that inefficient and complex bidding and tendering processes can lead to apathy amongst suppliers if not kill them off altogether.

Is the rail operations network a better place with less UK competition? I fear not. Was its running and service more efficient before it was privatised and commercialised? I think not.

Both Virgin and First Group are proven to be effective suppliers of rail operations and as a customer of the West Coast Line myself I hope that the new operators will succeed. However I question the timing of the change, the impact on market competition and the potential weighting of factors impacting the buying decision. I hope that the change will not mean derailment of what has become a flag bearer of UK enterprise.