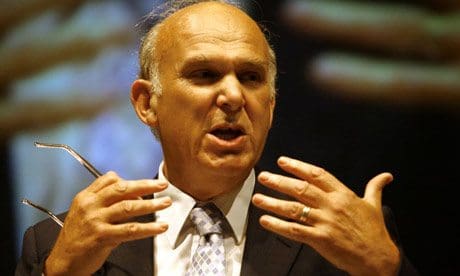

Mr Cable said the matter had been referred to them in January last year, reports The BBC.

He said he was very keen for a decision to be reached as quickly as possible to maintain public confidence.

RBS, which has its headquarters in Edinburgh, needed a £45.5bn taxpayer-funded bailout in October 2008.

In December 2011, a report by banking regulator the Financial Services Authority (FSA) said RBS, which owns Nat West and Ulster Bank, was brought to its knees by “multiple poor decisions” and a £50bn “gamble” on buying Dutch bank ABN Amro.

The report shone a light on the poor relations between the FSA and RBS and said chief executive Fred Goodwin’s “assertive and robust” management style was flagged as a potential risk as early as 2003, four years before the disastrous ABN Amro deal.

In January 2012, a month after the FSA report, Mr Goodwin was stripped of the knighthood he was awarded for services to banking.

Months later, the Crown Office in Scotland confirmed an investigation had been under way for some time because of “the degree of public concern about recently reported issues in the banking sector”.

In a letter to Westminster’s top Scottish law officer – Advocate General for Scotland, Lord Wallace – Mr Cable asked for an update on the progress of the case but insisted he was “not seeking to influence the outcome” of the legal process.

The business secretary told his fellow Liberal Democrat: “There is, as you will know, considerable public concern about the actions of the directors of RBS prior to its insolvency.

“Following the release of the FSA’s report into the failure of RBS I sought legal advice on what if any enforcement action was appropriate and was advised that the Crown Office and Procurator Fiscal Service (COPFS) should consider a possible prosecution.

“Given that this matter was referred to them in January 2012, I am very keen for a decision to be reached as quickly as possible in order to maintain public confidence in the efficiency of the decision-making process.”

Mr Cable added that “public and media interest in the banking sector and RBS have not dissipated”.

Earlier this month more than 12,000 private shareholders and 100 institutional investors raised a class action against the bank.

It relates to a £12bn rights issue by RBS in 2008 to shore up its balance sheet after its disastrous acquisition of ABN Amro.

Mr Goodwin is among those named in the action, along with ex-chairman Sir Tom McKillop and senior figures Johnny Cameron and Guy Whittaker.

Mr Cable has already instructed officials at his own department to look at the downfall of HBOS and whether there are grounds for banning former directors from holding boardroom positions.