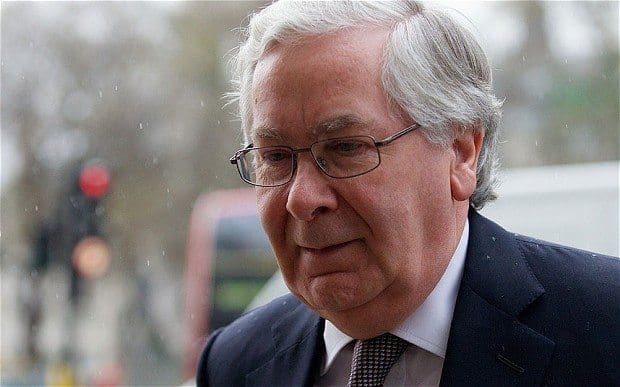

In one of his last speeches as governor of the Bank of England before he steps down at the end of June, Sir Mervyn said that retaining a 2pc target was an “essential” part of monetary policy.

It followed comments by Mr Carney, the current Bank of Canada governor who takes over at the Bank of England on July 1, suggesting that central bankers could abandon inflation targeting, reports The Telegraph.

He proposed an alternative mandate for “nominal GDP”, a measure of total growth before adjusting for inflation, if traditional measures fail to produce a recovery.

Mr Carney also floated the idea of fixing interest rates until unemployment hit “precise numerical thresholds” in times of economic crisis, regardless of the official inflation target. He insisted his comments were not meant for a specific country.

The Chancellor George Osborne has refused to rule out abandoning the inflation target in favour of a focus on growth, welcoming a debate on the future of Britain’s monetary policy framework.

Speaking at a CBI dinner in Belfast, Sir Mervyn said: “To drop the objective of low inflation would be to forget a lesson from our post-war history.”

“In the 1960s, Britain stood out from much of the rest of the industrialised world in trying to target an unrealistic growth rate for the economy as a whole, while pretending that its pursuit was consistent with stable inflation.

“The painful experience of the 1970s showed that this illusion on the part of policy-makers came at a terrible price for working men and women in this country.”

Inflation averaged at 13pc a year in the 1970s, peaking at 25pc in 1975.

Inflation targeting has been in place since Britain crashed out of the Exchange Rate Mechanism in 1992. While Sir Mervyn conceded that there are “certainly aspects of the inflation targeting regime to consider,” he said price stability should remain priority.

Sir Mervyn said that the 2pc target had not been a barrier to recovery during the current crisis, because there was sufficient flexibility built into the remit for the MPC to focus on growth as well as pricing.

He said recovery had instead been delayed because there is no easy way out of a banking crisis.

The governor suggested an extension to the Bank’s £375bn quantitative easing programme was a strong possibility if conditions deemed a further dose necessary, but said there were reasons to believe “a gentle recovery” is underway.

He signalled there was no immediate prospect of a rise in interest rates, which have been on hold at an all-time low of 0.5pc for almost four years.

Adam Posen, a former member of the MPC, said separately that nominal GDP targeting would be a “serious mistake”, pushing up inflation significantly.