Banning ads from payday lenders is a big move for Google, the most visited website in the world, against a massive and mostly legal market. Payday lending is a $46bn industry, and there are more payday loan storefronts in the US than McDonald’s and Starbucks combined.

The Guardian reports that the lenders – who generally give out small loans – use extremely high interest rates and target vulnerable, low-income communities, often entrapping people in circles of debt.

“Financial services is an area we look at very closely because we want to protect users from deceptive or harmful financial products,” said David Graff, director of global product policy for Google.

Google did not disclose how large a percentage of ad revenue payday lenders accounted for. The ban will go into effect on 13 July 2016. Google will also no longer allow ads for loans where repayment is due within 60 days of the date of issue or ads for loans with an annual percentage rate (APR) of 36% or higher.

Microsoft and Yahoo have not made similar changes despite being lobbied by consumer advocates, according to those advocates on a press call this morning.

Ads for payday loans appear not only on searches for lenders but also on related searches such as “I need money to pay rent,” according to Aaron Rieke, a principal at Upturn, a technology and civil rights group.

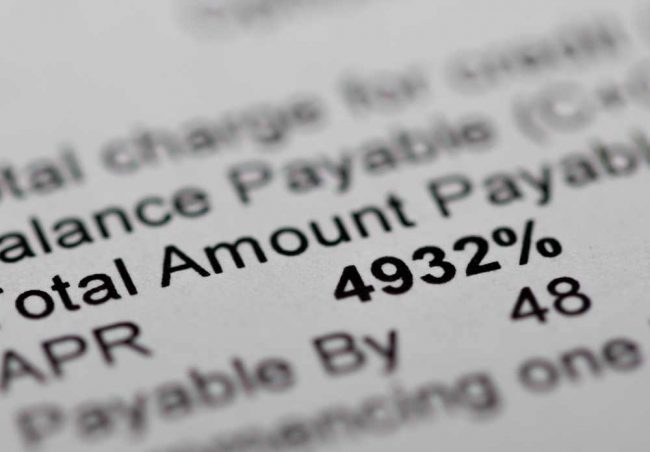

A typical two-week payday loan has an APR of almost 400%, according to the Consumer Financial Protection Bureau, while a credit card APR generally ranges from 12% to 30%.

“You go to a search engine when you need help, when you’re in trouble, when you’re broke, and you reveal to a search engine what you’d never reveal to anyone else,” said Alvaro Bedoya, executive director of the Center on Privacy and Technology at Georgetown Law. “You trust that search engine.”

Most search engines still allow payday lending ads that can charge up to 1,000% interest, according to Bedoya, who said Google’s move is toward a better internet that stops “profiting from your weaknesses”.

“If you’re broke and search the internet for help, you should not be hit with ads for payday lenders charging 1,000% interest,” he said.

Several advocates of the ban argued the internet can be “an agent of harm” when advertisers use it to prey on low-income consumers.

Janet Murguía, president and CEO of the National Council of La Raza, an advocacy group for Latinos, said the ban was an example of civil rights organizations and tech companies coming together “to help protect the rights of all Americans online”.

“Unscrupulous payday lenders prey on the most vulnerable, including millions in communities of color in neighborhoods across America, and in the 21st century, they are increasingly doing so on the internet,” Murguía said.

Payday loans have come under scrutiny in recent years after an explosion in short-term lending following the 2008 financial crash. Problems experienced by some people in meeting payments have provoked concerns both in the US and the UK.

Payday lenders were also unhappy with the decision. The first comment on Google’s policy update about the ban was from Manjush Varghese, whose Google Plus account identifies him as vice-president of e-commerce at ACE Cash Express, a payday loan lender.

“Extremely disappointed. I would love to know some of the facts and research you are referring to. I have been a long-standing, responsible advertiser on Google. Our prior attempts to engage with the policy group at Google have been consistently rebuffed,” he wrote.