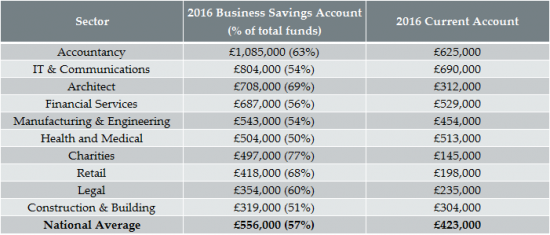

Charities invest an average of 77 per cent of their funds in business savings accounts, higher than the national average of 57 per cent, according to new research.

Architecture and retail firms are also active savers – investing 69 per cent and 68 per cent respectively of their total funds in business savings.

While charities may save the most money percentage-wise, businesses in the accountancy and telecoms sector have the largest savings pots – with average balances standing at £1,085,000 and £804,000 respectively.

Charities hold an average of £497,000 in business savings accounts, compared with the national average of £556,000.

Following the outcome of the EU Referendum, half of charities said they were increasing the amount of cash in their organisations to build a cash buffer, higher than the national average of 38 per cent.

This percentage is matched by SMEs in the construction and building industry.

Nearly half of legal SMEs said they were increasing cash reserves due to concerns about the UK economic outlook, followed by 21 per cent of architecture businesses – significantly higher than the national average of 12 per cent.

Stuart Hulme, Director of Savings at Hampshire Trust Bank, said: “Our study demonstrates the sector differences when it comes to the amounts businesses and organisations are holding in current and savings accounts. It’s encouraging to see charities and architects are confidently planning for their future, by placing the majority of their total funds into savings accounts.

“The organisations that have been stockpiling cash into current accounts should consider the opportunities to make more out of every £1 earnt.

At Hampshire Trust Bank, we continue to identify ways to meet the savings needs of SMEs – the engine room of the UK economy.

The benefit of making use of savings accounts is not only the interest rate return you get as a business, but also the knowledge that the money is being lent on to SMEs looking to grow, delivering double value and supporting investment in the UK.”