The Bank of England has withdrawn its support package for mortgage lending, warning that rising house prices could derail the UK’s recovery.

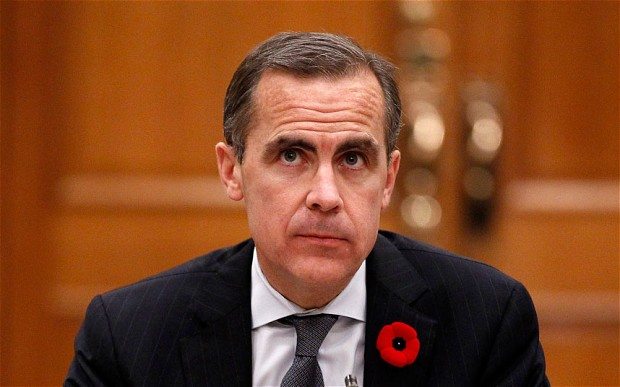

Mark Carney, the central bank’s Governor, said the Funding for Lending Scheme (FLS) – which allows lenders to borrow at rock-bottom rates in exchange for providing loans – would not apply to household lending from February next year.

The changes come as resurgent property values, which are growing at their fastest pace since before the financial crisis, stoke fears of a housing bubble caused by cheap money and the Government’s controversial Help to Buy scheme, reports The Telegraph.

Shares in the UK’s biggest housebuilders fell on Thursday on fears mortgage lending would be restricted. Persimmon, Taylor Wimpey and Barratt, the three biggest housebuilding groups, lost between 2.2pc and 6pc of their value, wiping £470m off their combined market value.

Mr Carney insisted that Help to Buy – which aims to help households move up the property ladder by incentivising banks to sell mortgages with small deposits – was not at odds with the changes, and that the decision had been jointly made by the Bank and the Treasury.

George Osborne, the Chancellor, said: “The FLS proved to be a successful tool in supporting the recovery. Now that the housing market is starting to pick up, it is right that we focus the scheme’s firepower on small businesses.”

Removing household lending from the FLS is the clearest sign yet from the Governor that the housing market risks destabilising the financial system. Mr Carney has previously stated that rising prices are confined mainly to the south east and that mortgage approvals are at historically-low levels.

However, he said on Thursday that the Bank’s Financial Policy Committee had become “concerned about the prospective evolution of the market in the absence of some of [the] changes”.

House prices in the three months to October were 6.9pc higher than a year previously, according to research from Halifax. Meanwhile, mortgage approvals reached a five-year high in September, the Bank of England’s own statistics show.

“The recovery in the market has broadened out across the UK; the question is where does it go from here,” Mr Carney said. “By acting now, authorities are reducing the likelihood that larger interventions will be needed. It is no longer appropriate to have our foot on the accelerator.”