Bitcoin came under pressure yesterday, enduring a sharp fall into the red which underlined the volatility of the world’s biggest digital currency.

Having rallied sharply as Facebook’s latest venture drew digital currencies into focus , the value of bitcoin fell by a tenth yesterday, to $11,621.30.

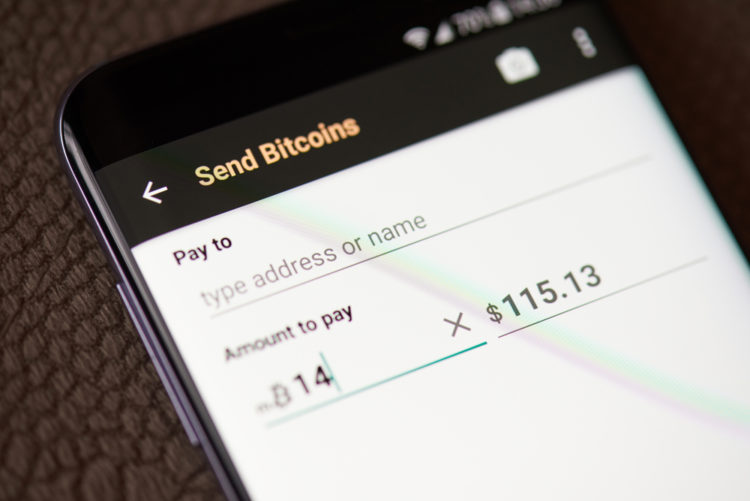

Such cryptocurrencies exist only as strings of computer code. They have no physical form.

Some policymakers and regulators likened the cryptomarket to an unregulated “wild west” after bitcoin soared from $960 in January 2017 to a peak at almost $20,000 that December, before slumping to just over $3,000 last year.

Facebook, which also owns WhatsApp and Instagram, revealed plans this month to launch libra, a cryptocurrency, next year. There was a mixed response amid unease at Facebook’s dominance online and the safety of user data.

Michael Novogratz, the hedge fund veteran who leads the blockchain company Galaxy Digital, said that much of bitcoin’s rise in recent weeks had been driven by those trying to shift capital out of China.

“I sold a little bit yesterday,” he told CNBC on Thursday. “I wish I sold a lot.”

Facebook’s announcement is forcing people to look more closely at cryptocurrencies, Mr Novogratz continued. “If you’re an institutional investor who’s getting close and still worried about investing, it makes you that much more confident and so we’re seeing institutions move into this place,” he said. “This whole run wasn’t institutions. It’s people front-running them.

“But it’s also China. A huge amount of the volumes of what’s going on in bitcoin and other currencies is coming out of Asia.”

Mark Carney, governor of the Bank of England, said last week that it would approach Libra “with an open mind, but not an open door”. Regulation and standards of social networks such as Facebook “are being debated well after they have been adopted by billions of users”, he noted, adding: “The terms of engagement for innovations such as Libra must be adopted in advance of any launch.”