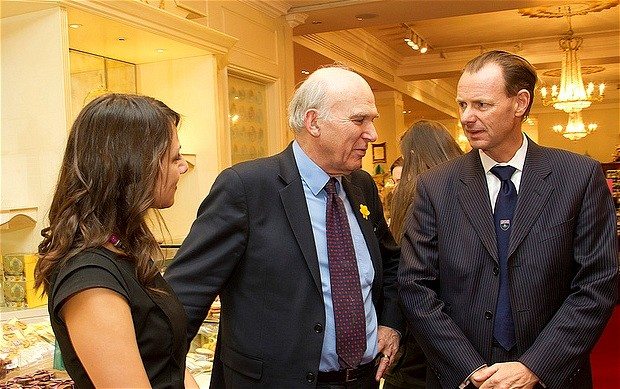

Vince Cable, the Business Secretary, has been handed a dossier which its author says reveal banks’ “disturbing patterns of behaviour” towards small and medium-sized businesses.

Government adviser Lawrence Tomlinson, who produced the research, said he had “exposed activity which flies in the face of the Government’s growth agenda”. Activities which “impede lending” include alleged malpractice in banks’ restructuring divisions.

Mr Tomlinson accused banks of loading punitive charges on struggling companies to maximise returns and bonuses and of “making directors passengers in their own businesses”.

He also highlighted what he said were conflicts of interest between banks and accountancy firms brought in to do “independent business reviews” of companies placed in restructuring divisions, reports The Telegraph.

Mr Cable finds the reports “worrying”, a business department spokesman said. Since “a number of the cases” in the dossier involve Royal Bank of Scotland, the Business Secretary has asked that they be considered by an independent review of the state-backed bank’s lending practices, which is being led by Sir Andrew Large, a former deputy governor of the Bank of England.

Mr Tomlinson, who was brought in to the Business Department to represent entrepreneurs’ interests, said he was struck by the “utter fear” companies have about speaking out against banks’ behaviour because of threats over “their facility being removed, BACS facilities restrained, or being subject to civil or criminal action”.

“There’s a huge disconnect between what banks are saying and what we are seeing. Businesses are being destroyed and people’s lives are being ruined by really bad behaviour.”

He compared the alleged misconduct in turnaround divisions to the interest rate swap mis-selling scandal, which is expected to cost lenders billions of pounds in compensation and legal fees.

Mr Tomlinson added that invoice finance, which sees cash advanced against companies’ order books, “appears sometimes to have been misused by banks to extract as much money from the business as possible, even if this means putting the business into administration”.

Figures which show that four in five applications for loans are accepted by banks are “extremely misleading”, he said, because so many businesses are being “actively deterred from accessing finance before being given the chance to apply”.

The report contains testimony from three bankers “who indicated that these issues occurred on an institutional level”, Mr Tomlinson said.

One former banker is quoted in the report as saying that “cruel, inhumane, non-commercial policies and decisions” taken against small business customers were the reason he left his bank.

Mr Tomlinson said: “There is a complete lack of trust towards the banks, and in many cases, this is … justifiable. This is coupled by an astonishing fear of the banks, no one dares tell it as it is.”

He encouraged companies affected by similar issues to “come forward”.

“It only takes the silence a few good men for bad behaviour to triumph. How can we increase lending when there is this level of distrust and the message remains ‘business as usual’ in the banks?

Mr Tomlinson, who runs LNT Group, which spans racing cars to care homes, added: “It is time for growth not greed. I want to tell people they are not alone and don’t need to be frightened – we’ll compile further evidence to stop this happening.”

A spokesman for RBS said: “RBS is the largest lender to SMEs in the UK. We have established an independent review of our lending standards and practices to identify steps we can take to support even more SMEs, and play our part in securing the economic recovery. We encourage businesses to submit information to the review which is running throughout the summer.”