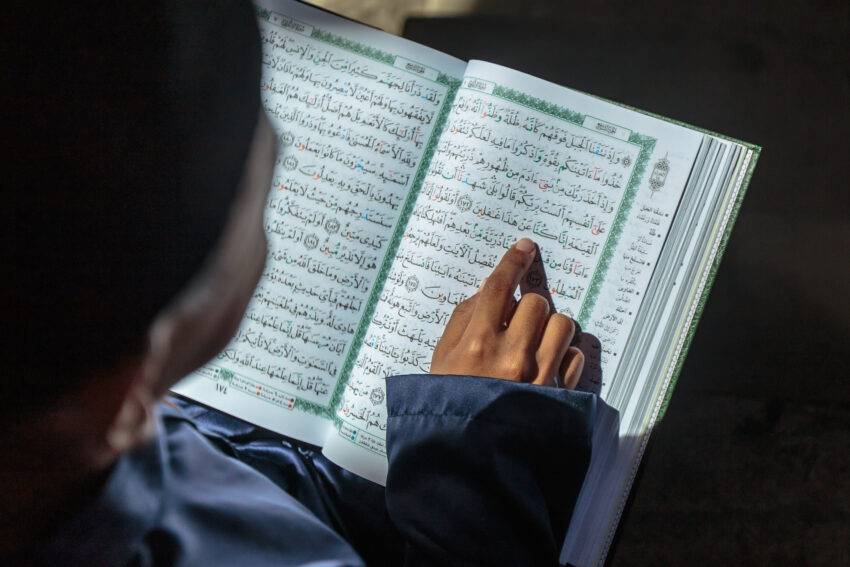

The Holy Quran, as the central religious text of Islam, provides guidance on a wide array of life’s aspects, including commerce and trade.

The verses within this sacred scripture emphasise the significance of ethical trade practices, fair dealings, and mutual consent in business transactions. Such principles aim to build a just economy and promote a balanced social order.

In Islam, trade is not merely a means to accumulate wealth but is seen as a way to contribute to society’s well-being and uphold the values of honesty, trust, and community welfare.

Here, we explore the Quranic perspective on trading, underscoring the ethical dimensions and moral obligations that accompany economic activities.

The Concept of Trade in Islam

The Arabic word for trade, ‘Tijarah’, is mentioned several times in the Quran, and it connotes a broader meaning than just buying and selling. It signifies any lawful transaction or activity involving exchange, such as bartering, leasing, and investing.

This inclusive definition reflects the Quran’s acknowledgment of various forms of economic engagement and the need to regulate them through divine guidance. Many Muslims ask themselves Is Trading Haram? Surprisingly, Islam does not prohibit trading, but it sets out principles to ensure that the trade is ethical and beneficial for all parties involved.

Ethical Guidelines for Trade

The Quranic teachings on trading are rooted in the belief that all wealth belongs to God, and humans are mere trustees. As such, it advocates for fair trade practices that uphold justice and morality above personal gain. Some ethical guidelines for trade mentioned in the Quran are as follows:

Honesty and trustworthiness

The Quran emphasizes the importance of honesty in all business dealings, requiring traders to fulfill their commitments and not deceive or conceal flaws in their products.

Fair pricing

Islam discourages price manipulation and profiteering. Traders are encouraged to set fair prices that reflect the true value of goods, without exploiting customers’ needs or vulnerabilities.

Mutual consent

The Quran emphasizes the concept of mutual consent in trade, requiring both parties to agree on terms and conditions for a transaction to be considered valid. This protects individuals from being forced into unfair or unethical transactions.

Social responsibility

Trade is seen as a means to contribute to the welfare of society, and traders are expected to fulfill their social responsibilities by providing quality products and services, creating job opportunities, and paying fair wages.

Avoiding interest-based transactions

Islam prohibits any form of usury or interest-based transactions, as they are considered exploitative and detrimental to both parties involved. Instead, it promotes profit-sharing and risk-sharing models in business partnerships.

Impact on Modern Trade

The Quranic principles of fairness, honesty, and social responsibility have a significant impact on modern trade practices. In today’s globalized world, where the pursuit of profit often takes precedence over ethical considerations, incorporating these principles can bring about positive change in the business world.

One area where the Quranic guidelines have a direct impact is in fair pricing. Many companies engage in price manipulation and exploitative tactics to maximize their profits, often at the expense of consumers. However, the concept of fair pricing in Islam ensures that goods and services are sold at their true value, without taking advantage of customers’ needs or vulnerabilities.

Additionally, the emphasis on mutual consent protects individuals from being coerced into unfair transactions or contracts. This promotes transparency and accountability in business dealings, which is essential for building trust and fostering long-term relationships with customers.

Moreover, the prohibition of interest-based transactions also has a significant impact on modern trade. It encourages businesses to adopt more equitable and ethical financial practices, such as profit-sharing and risk-sharing partnerships, which can lead to a more balanced distribution of wealth and resources.

Furthermore, the principles of social responsibility in Islam encourage businesses to prioritize community welfare over individual gain. This means considering the impact of their actions on society and the environment and taking steps to minimize any negative consequences.

This can lead to more sustainable and responsible business practices, which are crucial in today’s world where environmental degradation and social injustices are pressing issues.

Conclusion

In conclusion, the ethical guidelines emanating from Islamic principles offer a profound blueprint for conducting business in a manner that is not only profitable but also equitable and socially conscious. These guidelines challenge the prevailing norms of a profit-centric business environment, offering an alternative that stresses the importance of fairness, transparency, and community well-being.

By embracing such values, companies can pave the way for a more just economy that promotes overall social benefit while still achieving business success. Implementing these principles could be transformative, serving both as a foundation for individual businesses to flourish and as a catalyst for broader societal change.