In the rapidly evolving world of digital finance, Banking as a Service (BaaS) has emerged as a groundbreaking model that enables businesses to offer banking services without having to be banks themselves.

This comprehensive guide is tailored for new businesses looking to navigate the complexities of BaaS in 2024. From understanding the basics, to choosing the right provider and understanding pricing structures, we’ve got you covered.

Why Banking as a Service?

- Accessibility: BaaS platforms allow businesses of any size to offer financial services, democratizing access to the banking sector.

- Innovation: By integrating banking services, companies can innovate their product offerings, enhancing value to customers.

- Speed to Market: BaaS solutions provide a fast track to launching financial services, bypassing the regulatory and technological hurdles of traditional banking. 4.

- Cost Efficiency: Reducing the need for physical infrastructure and leveraging cloud technology, BaaS can significantly lower operational costs.

Why SaaS in Banking?

Software as a Service (SaaS) in banking, a subset of BaaS, offers cloud-based solutions for financial operations, ensuring scalability, flexibility, and reduced upfront costs. SaaS platforms enable:

- Scalable Infrastructure: Effortlessly adjust your resources according to demand.

- Continuous Updates: Access the latest features and security patches without significant downtime or additional costs.

- Global Compliance: Stay compliant with international regulations without constantly adjusting your software.

BaaS Providers: Navigating the Landscape

Choosing the right BaaS provider is crucial for your business’s success. Top providers in 2024 include:

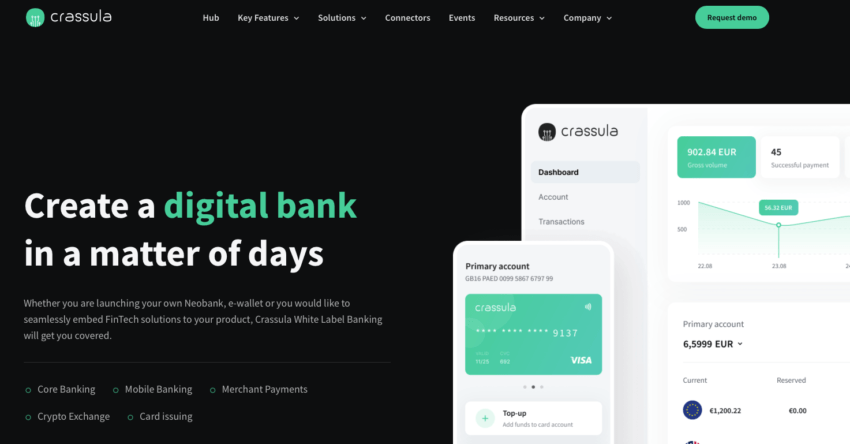

- Crassula: Provides a broad spectrum of banking services, including accounts, payments, and card issuance.

- Stripe: Known for its robust API and extensive suite of financial tools.

- Plaid: Offers easy integration for banking services with a focus on financial data connectivity.

- Solarisbank: A fully-licensed bank offering BaaS with a wide range of financial products across Europe.

How to Choose the Right BaaS Provider

- Services Offered: Ensure the provider offers the specific banking services your business needs.

- Regulatory Compliance: Choose a provider that helps you navigate the complex financial regulatory environment.

- Technology and Integration: Look for modern API interfaces and easy integration with your existing systems.

- Cost Structure: Understand the pricing model – whether it’s transaction-based, subscription-based, or a mix of both.

- Customer Support: Strong customer service is essential for resolving any issues that arise.

Understanding BaaS Pricing

BaaS pricing can vary significantly between providers and is influenced by the services offered, volume of transactions, and additional features required. Common pricing models include:

- Subscription Fees: A fixed monthly or yearly fee for access to the platform.

- Transaction Fees: Charges for each transaction processed through the BaaS platform.

- Custom Fees: For bespoke solutions or additional services beyond the standard offerings.

Conclusion

Banking as a Service represents a formidable opportunity for new businesses in 2024, offering a path to innovative financial service offerings with reduced overhead and increased speed to market. By carefully selecting the right BaaS provider and understanding the pricing models, new businesses can leverage this powerful platform to scale and succeed in the competitive digital landscape.