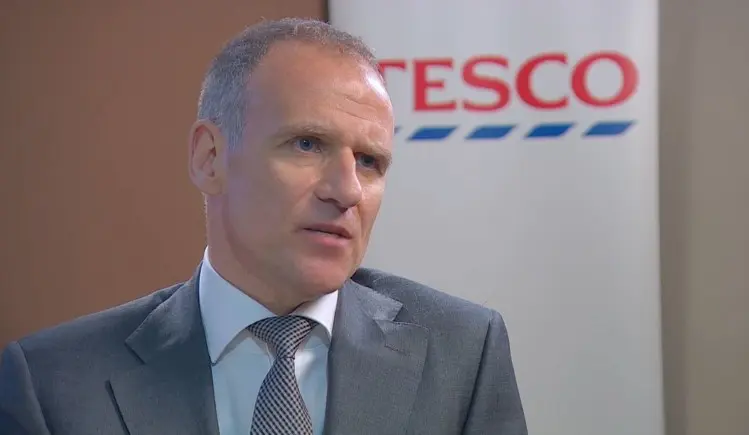

Supermarket giant Tesco is in hot water ahead of its AGM next week, over the “excessive” near-£5m pay deal it awarded its CEO for the 2017/18 financial year.

took home a base salary of £1.25m, as well as a £2.28m short-term bonus, £971,000 in shares from a long-term incentive plan and extra benefits and pension contributions which brought his total pay to £4.87m.

But shareholder advisory group Pirc is recommending that investors vote down Tesco’s remuneration report, which it deems to be unreasonably large.

“The salary of the CEO is considered to be the highest when compared to salaries of other CEOs in the peer group,” said Pirc in a note to its clients.

“This raises concerns about the potential excessiveness of the remuneration structure, as incentive awards are directly linked with salary levels.”

Pirc explained it considered the bonus awards, which together amounted to 260 per cent of salary, to be too high, and the ratio of Lewis’s pay to the average employee’s – which stands at 267:1 – to be “unacceptable”.

Lewis’s pay, which has continued to increase over the last five years and climbed more than 17 per cent over the last year, was also out of whack with the value Tesco has been creating for shareholders, Pirc claimed.

“Over the five year period average annual increase in CEO pay has been approximately 50.34 per cent whereas, on average, total shareholder return has decreased by 7.84 per cent,” the firm said.

Pirc also said that shareholders should vote down the amended remuneration policy, which allows for maximum potential awards under all incentive schemes to amount to a “highly excessive” 600 per cent of salary.

Tesco’s chairman John Allan did not escape Pirc’s criticism. The group once again advised against his re-election, as it has continually claimed that he holds too many senior jobs and may not have enough time to dedicate to them. Allan is also the chairman of housebuilder Barratt Developments.