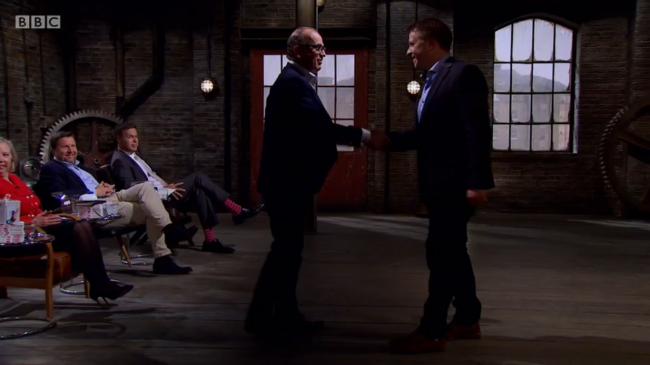

First into the den in hope to drive the Dragons into an ambitious investment of £200,000 for only a 2 per cent equity, was Dan Humet with his car parking app and website which helps track down parking locations within an area. I know you may have had to re-read that sentence, but yes, it’s true, he asked for £200,000 in exchange for a 2 per cent equity share – crazy, right?The concept of the business was actually quite convincing and potential was definitely granted to the product. As a driver myself, I would definitely find the app useful. Being quite an impatient individual, I would undeniably be satisfied with time saving in regards to finding parking spaces – particularly areas I’m not so familiar with.The money demands and valuation formed a continuum of rising concerns, however didn’t stop Dan from receiving offers. Peter offers all the money for 20 per cent, in which he profers to share with Nick who accepts a share. As Dan reveals he owns around 46 per cent of the business, 20 per cent is too much to share. He negotiates a 5 per cent share – in total! A 2.5 per cent equity share each, was just not inviting enough for neither Peter nor Nick. Clearly, Dan wanted to hold on to the majority of his 46 per cent share and so, his stubbornness to offer away more equity left him to leave the den empty handed. Now, I’ve already mentioned my impatient tendency, so when I heard Mustafa from ‘WellGelLondon’ state that their gel nail products work quicker than the existing gel products, I got a tad excited! I know the feeling of having to wait around 40 minutes for your gel nails to be perfected in a salon and for me personally, anything to speed up the process is inviting! With ‘non-toxic’ benefits and a ‘chemical-free, natural’ claim, I was urged to listen more closely. However, my excitement soon began to fade as Sarah declared her familiarity with other similar fast-process products currently on the market. Additionally, Deborah’s analytical eye on the product detail documents proved that some of Mustafa’s ‘non-toxic’ claims were too ambitious. The other Dragons resulted in a mutual feeling that the product didn’t have the potential to grow extensively and so Mustafa failed to gel down an investor. Next to grasp my attention was Alison Greeve, presenting two of her inventions – a non-slip service tray and a hand holder for tablets. She was hoping to grip onto a £75,000 investment for a 7.5 per cent stake in the business. Not going to lie, the tablet holder was something I’d seen in many forms already, but the non-slip tray was something of potential. After discovering Alison gradually placed focus on her second product – the tablet holder, Dragons were very questionable of this decision. The ‘targeted’ and ‘small’ market was not enticing enough for Peter and a quick decline in interest from the other Dragons left the entrepreneur empty handed.Finally, to conclude the series until later this year, Jamie Lawler pitched his company ‘Kids Flush’ – a button that fixes on-top of toilet flush buttons to aid parenting by encouraging children to flush after going to the toilet. Not only is the button an inviting, resplendent colour, it also makes a funfair noise each time the button is pushed, in a way to praise the child – which the Dragons found fairly amusing. With his retail aspirations, Jamie was hoping to seal a £40,000 investment for a 20 per cent share in his company. Most Dragons were not interested for the “product is not a business” as stated by Nick, who shared the same view with his fellow Dragons. Touker however, remained attentive and was yet to flush away an opportunity as quick as the other investors did. After deliberation, dramatism and a conventional den build up, Touker decided to grant an offer of all of the money, but for a 20 per cent higher share than Jamie’s asking equity. Jamie gratefully accepts the offer and the series concludes!

Dragons’ Den: The Dragons roar for the final episode