This month, the Chartered Trading Standards Institute (CTSI) received considerable evidence of banking scams sent via text messages.

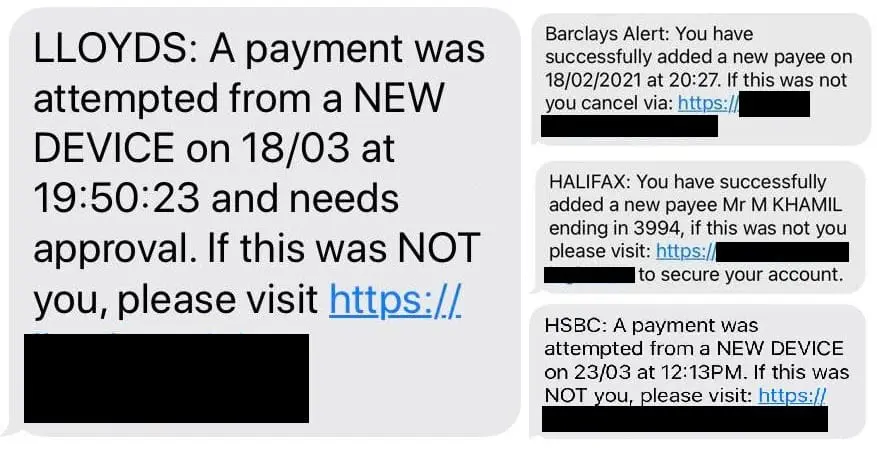

The scam texts, in most cases, pretend to be security messages from a bank requesting confirmation of a payment made from a digital device not used before. In another piece of evidence, the message asked the recipient to tap a link to confirm payment to a named person. All of the phoney messages contained links that request the recipient’s bank login details, putting the targeted person at serious risk of theft and banking fraud.

The evidence included messages claiming to be from four of the UK’s largest banks and building societies, including Barclays, Halifax, HSBC and Lloyds.

The warning comes with increased concerns as digital payments, mainly through mobile devices, have witnessed a surge during the COVID-19 pandemic. This warning arrives on the back of warnings about a scam campaign involving fake Royal Mail texts and emails.

Katherine Hart, a Lead Officer at CTSI, said: “I am witnessing so many reports of this scam; indeed, I have received multiple versions of it on my phone. The public is very vulnerable to this type of fraud, especially when more people rely on online payments.

“Fraudsters change the form and methods of their scams to match shifting consumer behaviour. The surge in online shopping and payments means that the public must be more vigilant when making online payments and receiving messages claiming to be from their bank.

“If you receive a suspicious text like this, please contact your bank directly and verify with them. Also, forward any scam texts to 7726, which is a free reporting service ran by Ofcom. We must protect ourselves and others from these scams but also provide vital intelligence to authorities.”