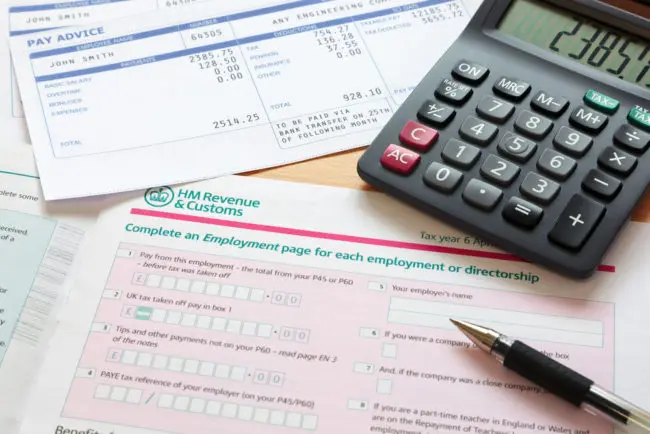

If you’re self-employed and thinking about filing your tax return online before the deadline of 31st January then this step-by-step guide will help you avoid any last-minute panic.

Do you need to file a tax return?

If, in the last tax year (6 April 2018 to 5 April 2019), you were self-employed as a sole trader and earned more than £1,000, you MUST file a tax return. You must also file one if you were a partner in a business partnership or director of a limited company whose income was not taxed at source and/or you have further tax to pay.

How to register and file a tax return online

Jack Haves, Product Marketing Manager, Sage explains that if you haven’t completed a tax return online before, you will need to register for an HMRC online account. You should contact HMRC before signing up to make sure you can activate your account before the Self Assessment deadline. If you have filed a return before but not last year, you will need to register again. Before applying online for Self Assessment, gather your UTR (unique taxpayer reference), National Insurance number and employer reference, if you have one. You will also need your bank or building society statements at hand and you may need your profit or loss account or other business records too.

Completing your tax return step-by-step

Once you’re ready to tackle the online form itself, browse the pdf version of the printed form if you want to familiarise yourself with the information you’re likely to need to supply. The information you enter on each page of the online form can be saved as you go along, allowing you to continue later and correct figures before you hit the submit button.

- Section 1: Fill in your personal details.

- Section 2: Fill in where you have received income or gains from, for example, from employment or self-employment, from a company or partnership, properties, trusts, capital gains, or from the UK or overseas. Answer “Yes” to any of the boxes in this section to show that you did receive income from any of these sources.

- Section 3: Enter any income from bank or building society interest, pensions, share dividends and benefits. It’s important to mention these even if you’re simply completing the Self Assessment because you’re a sole trader. HMRC needs to know about all your income, no matter where it comes from.

- Section 4: The form then asks for other information such as about student loans, pension contributions, gifts, donations, child benefit and marriage allowances.

Assuming you file on time, you must keep records of all information used to complete your Self Assessment tax returns. Self-employed businesses should keep this for up to five years after the 31 January deadline each year (otherwise you might face a hefty fine!)

Allowable expenses

If you’re self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit providing they are allowable expenses.

For example, these can include:

- Costs of running an office

- Uniforms or protective clothing

- Staff costs, for example salaries or subcontractor costs.

- Some or all of fees paid to professionals, such as accountants or lawyers.

- Costs of your business premises, for example heating, lighting, and business rates.

Making sure you file your return on time and what happens if you don’t

You will usually have to pay a penalty if you file your tax return after the deadline, or if you pay late. Filing late increases the chances of HMRC taking a closer look at your return. So, complete the form as early as possible to avoid stress and a missed deadline. If you expect to miss a tax payment deadline, contact HMRC immediately.

How to pay your tax

You must pay your tax up until midnight on 31st January. You can make a payment via online or telephone banking (faster payments), CHAPS, debit or corporate credit card online, your bank or building society, Bacs, direct debit (if you have set one up with HMRC before). The webpage on the government website ‘Pay your Self Assessment tax bill’ has more details on each option.

Why business owners may use an accountant and how much they cost

The main reason for doing your own tax return is to save money on accountancy bills. However, many business owners are too busy to do it themselves and find that using an accountant pays for itself quickly. Consulting an accountant should save money in tax savings, and in avoiding costly mistakes and penalties. Sole traders might be able to claim the costs for their accountant as an expense and the accountant themselves will know if this is allowable. If you’re looking for an accountant, locate one in your area by searching online, ask for recommendations from other small businesses or find one through Sage’s online directory.

By now you should be feeling less more confident about filling in and submitting your tax return form. If you decide to do it yourself, but are still not sure of anything, it’s important to remember that you can always contact HMRC to and ask them.

*Please note, this article doesn’t replace legal or professional advice. If you’re in any doubt, contact HMRC or a professional.