With the rising popularity of cryptocurrency trading in the global trade market, more and more people are intrigued by the prospect of lucrative earnings.

However, it is vital to understand that, like any other money market, the crypto market is a challenging curve that is still being explored. The reality is that the world of cryptocurrency is still in its nascent stages, and as such, making mistakes are more common than you think.

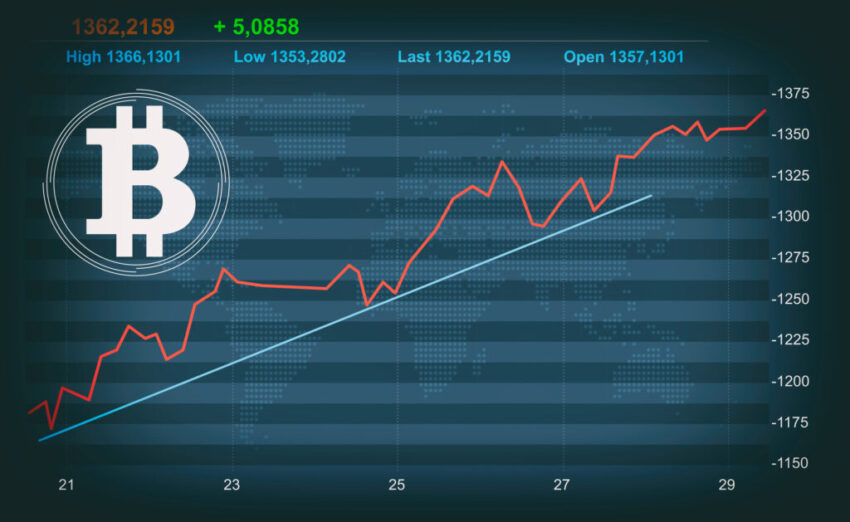

Trading in digital currencies is undoubtedly a profitable venture. But for that, you need to be aware of the market trends, price movements, and many more factors that influence the market. Moreover, the volatile nature of the crypto market is not a secret. Visit bitpal for more information.

Beginners and even at times, experienced traders make mistakes when it comes to crypto trading. In order to aid the cryptocurrency traders to avoid massive financial blows, we have compiled a list of the top mistakes that you must know and steer clear of.

Panic selling

A common mistake that every amateur trader makes is panic selling. It is entirely possible that the price of the coins you have drops below your estimations. In that case, traders are often surged with panic and are forced to either wait for the hike in prices or sell them at a lower value than the market price.

Panic selling is not a wise decision if you want to opt for long-term trading. When the value of the coin goes down, you must re-assess the situation and then make a decision. In these critical times, you must research about any recent news, the shift in fundamentals of the coin, and the worth of the coin in the future.

If your analysis reports and research matches your belief in the uprise of the coin price in the near future, then abstain from making a decision. However, keep in mind that you must only trade the amount that will not cause turbulence in your financial status.

Being influenced by the lure of P&D schemes

Pump and Dump or P&D deals are made by some groups of cryptocurrency investors. “Pump” means buying the crypto coins and then increasing its price quite unbelievably to present a lucrative deal to the traders. And “Dump” indicates the luring of the traders and then selling off those crypto coins for making more profit.

Now, even though such deals sound quite appealing for an amateur trader, in reality, however, the trade is unreliable at best. It is advisable to excise caution if you suddenly observe a price hike in usually low-performing cryptocurrencies.

Relying more on chances than on skills

While gut feelings are a blessing, using them too much for crypto trading might not be a wise decision. Instead of chance or luck, make trades based on detailed reports, information, and calculations.

Make sure that you remain updated about any news of the industry. Also, develop contingency plans in case of a particular coin price drops. This way, you can still move forward and ensure the minimization of losses. Moreover, you must dedicate a substantial amount of time to conducting research on the market.

Not having proper knowledge of crypto trading

Venturing into trading with insufficient information is a recipe for disaster. In this case, you can face massive losses. In order to ensure that you make profitable trades, you must study the cryptocurrency market in detail. Study the trends, patterns, and various graphs and charts. If you think that it can be mastered within a span of a few days, you are mistaken.

If you are interested in a specific crypto coin, conduct proper research. You can start with the country of origin, operation history, the ups and downs in the prices, etc. Also, you can join a genuine investment group to enhance your knowledge.

A word of caution! Refrain from depending on the expert opinions of crypto gurus in the various social media platforms.

Conclusion

Trading cryptocurrencies is a challenging but incredibly profitable prospect. However, you must remember, that trading, especially in digital currencies, is not as easy as you perceive it to be. In fact, it can cause you severe economic losses if you are not aware of the pitfalls. It is why traders often approach with caution, strategies, and a well-designed plan.

For that, you must educate yourself on the intricacies of crypto trading. If you are serious about making an earning via this venture, then you must take into account the above-listed mistakes. Armed with information, skill, and a little luck, you can soon earn more profits than you have imagined.